This app can be used to obtain information regarding the refund status of your Ohio and school district individual income tax return, check the Ohio sales tax rate for all addresses in the State of Ohio, calculate sales tax due and view news about Ohio taxes.

Check the Refund Status of your Ohio and School District Individual Income Tax Refund(s)

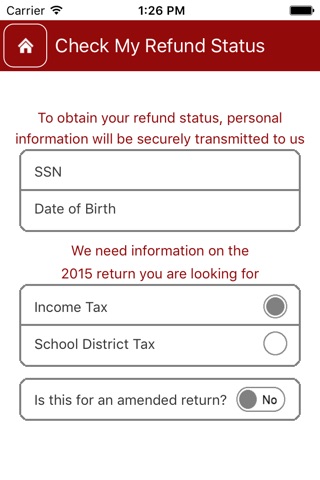

This application only allows you to check the status of the return filed in the current year for the previous tax year. You must enter some personal information and identify the tax type and return type you are inquiring about. Features include:

•Entry of your social security number, your date of birth, the type of tax and whether it is the original or an amended return.

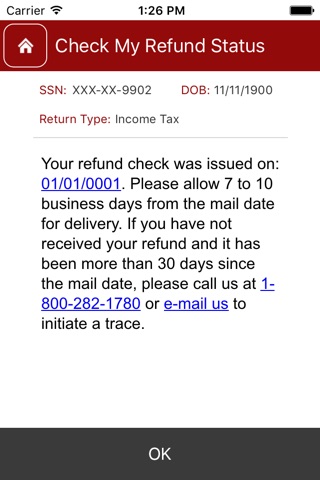

•Once you have received the results of your refund status request, you may click “OK” to be directed back to the input screen. This allows easy access to change the information you provided and check the status of another refund.

•Alert messages will display for any planned outages to let you know in advance when the system may not be available, or is down for maintenance or repair.

Look up an Ohio Sales Tax Rate

This application allows you to check the sales tax rate and county code for any location in Ohio. The application makes it easier to collect and keep track of sales tax on the go. Features include:

•The ability to enter an address, zip code or your current location (using GPS) to calculate the amount of sales tax to collect or pay.

•Calculation of the total amount to collect (sales amount plus sales tax) from a customer.

•The ability to save the sales tax information and retrieve it at a later date.

•The ability to send the sales tax information by email or text message.

Disclaimer

Information is believed to be accurate but not guaranteed. The state of Ohio disclaims liability for any errors or omissions.

Other Features

•Information on Ohio Small Business Tax Deduction and Income Tax Cuts.

•Access to our Facebook page.

•Phone, email and website contact information.